November 14, 2025

Summary:

Global logistics in 2025 is shaped by overlapping disruptions: strikes, carrier consolidation, and fast-changing tariffs. Customs enforcement is stricter than ever, with rising penalties and shrinking de minimis exemptions. Consumer demand is still strong but shifting toward emerging markets and resilient categories like Health & Wellness and Beauty. Merchants that diversify carriers, regionalize fulfillment, and automate compliance will be best positioned to grow.

Intro

Global logistics in 2025 looks very different than it did just a few years ago. What were once isolated shocks, like a port strike or a sudden tariff hike, have become overlapping disruptions across multiple fronts. Labor unrest, carrier consolidation, customs crackdowns, and shifting consumer demand are colliding to reshape the way goods move across borders. For merchants, this environment is both volatile and full of opportunity: those who adapt quickly with resilient supply chains, proactive compliance, and market-driven strategies will be best positioned to grow.

Labor disruptions aren’t a shock anymore; they’re a baseline

For decades, strikes were treated as rare, disruptive events. Today they are woven into the operating fabric of global logistics. Since late 2024, labor unrest has hit multiple regions at once, forcing merchants and carriers to adapt in real time.

In Canada, a Canada Post strike during the 2024 holiday season left roughly one-third of parcels delayed, pushing merchants to divert shipments to private carriers at a steep cost. The turbulence didn’t end there. In spring 2025, the Canadian Union of Postal Workers escalated further action, and by June, DHL Express Canada was forced into a full suspension after a lockout triggered strikes. Because of new labor rules under Bill C-58, which ban replacement workers, DHL had no way to operate until a deal was struck.

Similar tensions are appearing worldwide. Dockworkers in Northern Europe, customs officers in Brazil, and terminal staff in Australia have all staged strikes or slowdowns that rippled far beyond their borders. The combination of wage pressure, fear of automation, and restrictive labor legislation means shippers can no longer treat labor unrest as isolated. It is now a recurring operating condition.

The lesson is clear: resilience cannot be built around a single carrier or route. Merchants that diversify with national, regional, and specialty carriers are best positioned to reroute volume, uphold delivery promises, and maintain leverage in rate negotiations.

Consolidation is rewriting the carrier landscape

Alongside strikes, consolidation is reshaping how goods move. 2025 has seen a surge in acquisitions as carriers race to expand reach and add specialized capabilities. UPS has been particularly aggressive, acquiring Andlauer Healthcare Group for $1.6 billion to build a robust cold-chain network, and moving to acquire Estafeta in Mexico to capitalize on nearshoring and cross-border U.S.–Mexico flows. FedEx, meanwhile, purchased RouteSmart Technologies, betting that advanced routing software will deliver efficiency gains across its global network.

The tech platforms aren’t sitting idle either. Amazon has steadily expanded Amazon Shipping in the U.S. and Europe, putting itself in direct competition with traditional carriers for merchant parcels. These moves reflect a broader race toward end-to-end, tech-enabled logistics ecosystems. Networks that don’t stop at moving packages, but also manage customs, fulfillment, and last-mile in one integrated offering.

For merchants, consolidation is a double-edged sword. A handful of mega-providers can offer scale and breadth, but they also introduce dependency. Many shippers are keeping regional players in their mix to avoid over-reliance and preserve negotiating leverage.

Carriers are restructuring networks for efficiency and resilience

As parcel growth levels off post-pandemic, carriers are reinventing their own operations. FedEx’s “One FedEx” initiative epitomizes this shift: merging its Express (air) and Ground (road) divisions into a unified network. The overhaul is designed to eliminate duplicate routes, consolidate facilities, and shift more non-urgent freight to rail—all part of a plan to generate billions in savings by 2027 while building a leaner, more agile network.

The trend is global. In the UK, Royal Mail is folding Parcelforce into its core mail business to cut overhead. Australia Post and Canada Post are restructuring to focus squarely on parcels, reallocating resources away from legacy letter delivery.

Merchants are adapting too, with a sharp move toward regionalized fulfillment. Splitting inventory across hubs closer to customers not only shortens transit times but also provides redundancy. If one region faces disruption—a strike, a storm, or a customs backlog—another can keep shipments flowing.

Technology sits at the center of this transformation. AI-driven route optimization, warehouse automation, and improved customer-facing delivery tools are being deployed at scale. The goal is not just efficiency, but resilience: networks that can flex and adapt under pressure.

Tariffs and customs enforcement: the pressure point for 2025

If labor unrest and carrier restructuring are reshaping logistics operations, customs and tariffs are redefining the economics. Cross border ecommerce in 2025 is operating in the most volatile trade environment in a decade. Countries are introducing trade interventions at triple the pace of five years ago, while customs agencies tighten enforcement on valuation, classification, and Country of Origin (COO).

In the first half of the year alone, tariff escalations between the U.S., Canada, Mexico, and China have forced merchants to rethink sourcing and pricing. Enforcement has intensified, with penalties for errors reaching up to $1 million per violation. And that is just the tip of the iceberg, check out our Trade and Tariff Hub for a more complete update or read our State of Cross Border II: Trade and Customs Report.

Key shifts to watch:

- De minimis removal: This U.S. removed their de minimis exemption causing widespread shut downs of postal services and greatly increased pricing on U.S. imports.

- Compressed timelines: New tariffs and restrictions are being implemented in days, leaving no time for manual compliance processes.

- Conversion impacts: Rising landed costs are driving cart abandonment, especially in apparel and home goods. Beauty and health products are proving more resilient when offered with Delivered Duty Paid (DDP).

- Compliance risks: Increased audits are here to stay, with fines and shipment seizures becoming a real cost of doing business for non-compliant merchants.

The takeaway: compliance is no longer optional. Automating HS code classification, pricing dynamically, and pairing DDP with regional fulfillment can help offset friction while ensuring predictability at customs.

Consumer signals: resilience with divergence

Together, labor unrest, carrier consolidation, and stricter customs enforcement are reshaping how goods move, and raising the stakes for merchants that rely on cross border growth. But while the supply side is in flux, the demand side tells a different story. Global consumers haven’t pulled back; instead, they’re shifting where they buy and what they’re willing to pay for. Understanding these demand signals is essential for merchants navigating this volatility. The following data is from a a deep dive into consumer behavior with our State of Cross Border report where the data is derived from FlavorCloud’s proprietary dataset, which aggregates global shipping, customs, and trade compliance activity across our platform in all markets supported. This includes insights based on FlavorCloud’s unique dataset powered by hundreds of millions in gross merchandise value (GMV) shipped across borders.

Despite the headwinds, global appetite for cross border products remains robust. What’s changing is where demand is accelerating and which categories can withstand rising logistics and compliance pressures.

Emerging markets are showing outsized growth: shipments to the UAE have risen 198% year-over-year, New Zealand is up 131%, and Singapore 85%. Mature markets like Canada and the UK continue to deliver volume, but growth depends on efficiency and retention strategies rather than raw expansion.

Category performance is also diverging. Health & Wellness remains the standout with 201% year-over-year growth, followed by Beauty & Cosmetics at 47%. Apparel, by contrast, has dipped slightly under the weight of tariff pressures and intensifying competition. These shifts closely mirror the operational pressures outlined earlier: categories with higher margins and clearer regulatory pathways are outperforming.

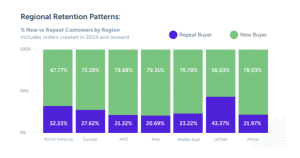

Consumer behavior within each market also reflects the broader logistics climate. Australia and New Zealand boast conversion rates near 20%, while Latin America struggles at 5% due to high duties and complex import rules. The Middle East leads globally in AOV at $160.86, highlighting opportunities for premium positioning. Retention remains strongest in Latin America (43%) and North America (32%), while newer markets like Singapore and New Zealand require stronger post-purchase engagement and clearer returns experiences.

For merchants, aligning strategy to these signals is key. High-AOV regions justify premium delivery promises. Price-sensitive regions demand transparent checkout and localized pricing. And in high-loyalty markets, merchants should double down on post-purchase engagement to maximize lifetime value.

Looking ahead

The global logistics landscape of 2025 is defined by constant disruption: strikes, restructuring, tariff escalations… but also by opportunity. Merchants that embrace proactive compliance, carrier diversification, and market-driven strategies will not only weather volatility but unlock growth.

Want to dive deeper into these shifts? Download the State of Cross Border Report for data-backed insights on trade, tariffs, and consumer behavior shaping the next era of ecommerce logistics or connect with an expert.

Grow your

Revenue

Revenue

With international sales on the rise, the opportunities have no borders. With FlavorCloud, you can tap new markets risk-free by offering global guaranteed delivery promises. Go global today.