December 8, 2025

Cross border BFCM 2025 unfolded within one of the most unpredictable trade environments in years. Many brands expected turbulence due to tariff adjustments, regulatory reform, the removal of de minimis thresholds in key markets, and rising scrutiny on cross border shipping. Instead of a downturn, the season delivered strong global performance. Shoppers remained active, but they applied far more scrutiny to landed cost, reliability, and transparency.

This benchmark review breaks down the most significant insights from the season and translates them into practical takeaways for merchants preparing for 2026.

1. A disruptive trade year with resilient shoppers

International growth continued despite major global headwinds. Across FlavorCloud merchants:

-

International revenue increased 27 percent

-

Order volume increased 8 percent

These gains are notable considering the scale of regulatory and tariff changes merchants navigated. Rather than pull back, shoppers changed how they made cross border decisions. They became more selective and more value-conscious. They spent time comparing duties, reviewing delivery timelines, and prioritizing merchants who offered clear, predictable flows at checkout.

The strongest indicator of this shift comes from how shoppers interacted with DDP pricing and transparent workflows. Merchants who presented accurate landed costs, consistent delivery estimates, and supportive post-purchase experiences captured the majority of growth. Those reliant on DDU, or those who introduced friction in duties and delivery, saw softer performance in both conversion and AOV.

What this means for merchants: Clarity is no longer a differentiator. It is a requirement. Consumers are benchmarking your checkout against the most reliable global retailers, not domestic competitors. Brands that align with that expectation win conversion, loyalty, and lifetime value during volatile periods.

2. Volatility by vertical: clear leaders and lagging categories

This year’s category performance showed one of the widest spreads in recent BFCM cycles:

-

Health and Wellness: +124 percent

-

Apparel and Fashion: +111 percent

-

Beauty and Cosmetics: +13 percent

-

Household Goods: –32 percent

The variance is not random. It reflects how different verticals respond to tariff exposure, shipping complexity, and consumer need-state.

Health and wellness brands benefited from strong replenishment behavior and relatively predictable landed costs. Apparel and fashion also excelled, driven by fast-moving seasonal demand and high tolerance for shipping variability. Beauty grew modestly but consistently, supported by low duties across many markets and strong gifting behavior.

The most significant decline came from household goods. Larger, heavier, or bulkier items were especially sensitive to tariff increases and delivery predictability. Shoppers avoided uncertainty around high duties and complex delivery, and many deferred non-essential large-item purchases.

For merchants in slower categories, this is a warning signal. Consumers are not reducing interest in cross border purchases. They are rejecting uncertainty. This creates a significant opportunity for brands to reassess pricing structures, explore DDP, improve accuracy in HS classification, and consider regional inventory to reduce delivery variability.

3. A shift in the top global markets

Your top five markets represented 73 percent of all cross border revenue. Even within this concentration, the year-over-year movement varied dramatically:

-

United Arab Emirates: +226 percent

-

United Kingdom: +54 percent

-

Germany: +52 percent

-

Canada: +0.3 percent

-

Australia: –3 percent

This is one of the clearest indicators that global demand is redistributing. Traditional “top markets” such as Canada and Australia were flat or slightly down, while markets with rapidly expanding middle classes and improving trade lanes surged ahead.

The UAE stands out with triple-digit growth fueled by rising purchasing power, improved air freight reliability, and strong demand for North American products. Germany and the UK also delivered impressive results driven by predictable VAT frameworks and strong ecommerce adoption.

For merchants, this is a strategic pivot point. It is no longer sufficient to rely on historic “safe bets” in global ecommerce. Brands that expand into emerging high-intent regions are seeing faster, more sustainable revenue growth.

The implication: Merchants should re-evaluate their international market prioritization for 2026. Market-level performance has shifted, and budgets, inventory, and fulfillment resources should shift with it.

4. AOV growth as shoppers optimized for clarity

Average order value rose from 114.26 USD earlier in the year to 136.36 USD during BFCM. This represents a 20 percent uplift, which is substantial considering the macro environment.

AOV growth signals that shoppers were not simply hunting for low prices. They were evaluating the quality of the entire cross border experience. When duties and taxes were presented clearly, and when delivery timelines were credible, buyers felt comfortable adding more to their carts.

Categories responded differently:

-

Apparel saw strong upsell activity and larger baskets

-

Beauty benefited from multi-item gifting

-

Household goods saw smaller increases due to uncertainty around duties

-

Health and wellness remained steady, driven by refill and replenishment behavior

The pattern is consistent across nearly all merchants. Transparent landed costs reduce buyer hesitation and directly encourage higher-value purchases.

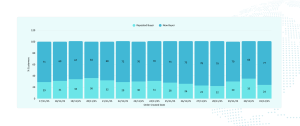

5. New buyers dominated November

One of the most important findings from the benchmarks is the ratio of new to repeat buyers. Throughout November, new buyers accounted for 66 to 79 percent of orders each day. Repeat buyers remained stable but represented a smaller share.

This surge in new customers shows strong global appetite for discovering new brands, even in a complex trade environment. Shoppers are willing to test new merchants when pricing is clear, delivery feels dependable, and returns appear manageable.

The opportunity now sits in what happens after BFCM. Retention will determine whether these new customers convert into long-term global revenue. Merchants with localized tracking, proactive delivery communication, and clear return instructions will see the highest gains in repeat behavior over the next six to twelve months.

A new landscape forming

Across every metric, the same pattern appears. Global demand is healthy, but the distribution of that demand is shifting. Category resilience ties directly to essential consumer needs. Buyers reward clarity in duties and delivery and penalize uncertainty more aggressively than in prior years.

The cross-border ecosystem has matured. Consumers understand landed cost. They recognize the difference between DDU and DDP. They expect transparent communication after checkout. Merchants who anticipate these expectations are outperforming even in volatile cycles.

This marks a turning point for cross-border commerce: growth is no longer driven solely by expansion into new markets but by excellence in execution.

What successful merchants prioritized

A clear profile of high-performing merchants emerged this BFCM season:

They invested in markets showing high-intent growth.

Brands focused on regions with strong YoY gains such as the UAE and Germany. This allowed them to capture surging demand ahead of competitors.

They leaned into resilient verticals.

Pricing and inventory strategies aligned with categories that held steady through volatility.

They focused heavily on checkout transparency.

Accurate duties and taxes built trust and supported both conversion and AOV increases.

They strengthened retention through localized post-purchase communication.

Fast, clear, and localized updates supported repeat buying behavior.

They prepared early for ongoing regulatory shifts.

With more customs changes expected through 2026, merchants who invested in compliance and data accuracy reduced friction and protected margins.

Grow your

Revenue

Revenue

With international sales on the rise, the opportunities have no borders. With FlavorCloud, you can tap new markets risk-free by offering global guaranteed delivery promises. Go global today.