August 20, 2025

Summary

On August 29, 2025, the United States will eliminate its $800 de minimis exemption—an exemption that has long enabled Canadian merchants to ship low-value parcels into the U.S. without duties, taxes, or full customs clearance. The impact of the removal of the de minimis exemption on Canada will reshape ecommerce and logistics across North America. For Canadian merchants, it means higher costs, new compliance hurdles, and potential shipping disruptions. For U.S. consumers, it means steeper prices and fewer cross-border shopping options. With Canada relying on the U.S. for more than three-quarters of its exports, the end of de minimis marks the close of an era of friction-free trade between the two countries.

Introduction

On August 29, 2025, the United States will eliminate its long-standing $800 de minimis import exemption. For years, this policy has allowed low-value shipments to cross into the U.S. without duties, taxes, or full customs clearance making it one of the most consumer and merchant-friendly thresholds in the world.

For Canada, this change is seismic. With the U.S. serving as Canada’s largest trading partner by a significant margin, the removal of de minimis is set to reshape ecommerce, logistics, and consumer shopping experiences across the border.

Learn more:

Canada’s heavy reliance on the U.S. market

The numbers tell the story. In 2024, over 85% of Canadian exporting enterprises sold to the United States, many relying directly on the de minimis exemption to ship ecommerce orders quickly and affordably. According to trade data, the United States topped the list as Canada’s largest trade partner, accounting for $435.17 billion in exports, or 76.4% of Canada’s total exports.

This reliance means that thousands of Canadian brands from DTC apparel companies to nutritional supplement makers and the 3PLs that serve them, structured fulfillment around the $800 rule. Shipments under this threshold could move seamlessly into the U.S., bypassing the duties and administrative burdens that larger shipments faced.

Now, every Canadian product, whether it’s a $30 pair of slippers or a $3000 wholesale order, will face full customs clearance and duties when entering the U.S. This includes the 35% tariffs which started on August 1.

How will direct consumer cost increase?

The clearest impact of de minimis removal is cost. Without the exemption, even everyday goods will see dramatic price increases once duties, tariffs, and processing fees are applied.

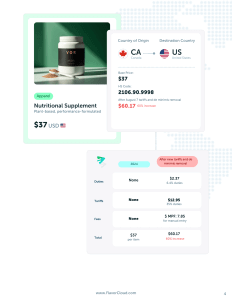

Take the example of a Canadian nutritional supplement valued at $37 USD. After duties and tariffs, the landed cost rises to $60.17 USD. A 60% increase! This spike comes from a 6.4% import duty, a 35% Made in Canada tariff, and a $7.85 merchandise processing fee (MPF).

The MPF is a U.S. Customs fee charged on nearly all imports. Shipments cleared under Section 321 de minimis were previously exempt, which is why Canadian merchants and consumers never saw this charge. Now, without de minimis, every shipment will incur an MPF. For low-value goods, that’s usually a flat fee: $2.62 for automated entry, $7.85 for manual entry, or $11.78 if processed by a CBP officer. For higher value formal entries, it becomes a percentage of the shipment’s value, capped at set minimum and maximums.

For U.S. consumers, this means higher checkout prices, fewer bargains when buying directly from Canadian merchants, and the erosion of the “duty-free convenience” they’ve grown accustomed to. For Canadian brands, it raises the stakes in pricing strategy, transparency, and customer communication.

How does de minimis affect logistics disruption for Canadian shippers?

Beyond consumer costs, the removal of the U.S. de minimis exemption fundamentally changes the logistics math for Canadian merchants and if low value shipments will meet the necessary criteria to pass into the US.

As part of this shift includes US CPB requiring any cross border shipments need to include HS codes starting September 1, several foreign postal operators have already announced suspendions or restrictions on U.S.-bound parcel service. Belgium’s Bpost, PostNord (Sweden/Denmark), and Posten Bring (Norway) have all announced temporary halts, while Omniva (Estonia) and Latvijas Pasts (Latvia) stopped accepting parcels to the U.S. in August. These measures were taken because carriers must now collect duties upfront, transmit HS codes and country of origin data, and operate as bonded carriers before U.S. Customs will release parcels. Canada Post has not issued an explicit suspension notice, but given these requirements and early reports of shipments being rejected at the border, Canadian merchants should expect similar disruptions or delays until a compliant system is in place.

For years, Canadian companies leveraged U.S. air shipping networks to consolidate parcels and access lower global rates. These networks were efficient because parcels under $800 moved friction-free through customs. Now, those same flows will be slowed by additional clearance requirements, adding costs and delays.

To remain competitive, Canadian fulfillment providers and 3PLs will need to restructure operations. That includes:

- Investing in accurate HS code classification to avoid mis-declarations

- Building landed cost calculation tools into checkout for transparency

- Diversifying shipping routes away from sole reliance on U.S. routing, opening up Canada-to-world lanes to maintain efficiency

What is the impact on consumers?

For Canadian goods, the effect will be felt on both sides of the border. U.S. shoppers who once enjoyed quick, affordable access to Canadian brands may face higher shelf prices, longer delivery times, and fewer product options.

This could mean fewer Canadian wellness products, fashion brands, and home goods appearing on major U.S. marketplaces, as smaller brands may struggle to absorb the added costs. For Canadian merchants, the change risks limiting access to their largest export market at a time when competition is already fierce.

For Canadian consumers, the disruption is twofold. Not only will products imported into Canada from the U.S. face reciprocal policy changes, but Canadian ecommerce firms that depended on de minimis to fuel growth may scale back operations, limiting choice and innovation in the domestic market as well. Keep up to date with the latest reciprocal action on the FlavorCloud Trade and Tariff Hub.

Conclusion

The end of the U.S. $800 de minimis rule represents one of the most significant trade policy changes in recent years. For Canada, the impact will be profound. With the U.S. representing more than three quarters of Canada’s total exports, Canadian ecommerce merchants, 3PLs, and consumers are on the front lines of this shift.

Higher prices, increased logistics complexity, and reduced consumer choice will define the new landscape. Canadian companies that adapt by investing in compliance, restructuring fulfillment flows, and rethinking pricing strategies will be best positioned to weather the change.

For everyone else, the message is clear: the age of friction-free cross-border trade between Canada and the U.S. is over.

If you have any questions on de minimis, need an alternative shipping for Canada Post, want compliance support, or want to meet with an expert book a meeting today. We’ll also be at Ecom North in September if you are in Toronto and would like to meet in person.

Grow your

Revenue

Revenue

With international sales on the rise, the opportunities have no borders. With FlavorCloud, you can tap new markets risk-free by offering global guaranteed delivery promises. Go global today.