August 14, 2025

Summary

Starting August 29, 2025, shopping from overseas is about to get more expensive.

The U.S. will eliminate the $800 de minimis rule, an exemption that has long allowed low-value shipments to enter the country duty-free and with minimal paperwork. This change is designed to close loopholes in international trade but will have a direct and immediate effect on the prices you pay for goods from abroad, the speed of delivery, and the variety of products available.

In this post, we’ll break down what’s changing, why it matters, and what it could mean for your online shopping habits.

If you are a merchant and concerned about the end of de minimis, you might want to check out our blog on The end of the US $800 de minimis rule and what it means for international ecommerce merchants.

What is de minimis and why does it matter?

De minimis is a customs threshold that lets goods below a certain value enter a country without duties, taxes, or full customs formalities. For the U.S., that threshold has been a generous $800 since 2016, one of the highest in the world.

This policy made it easier and cheaper for consumers to buy directly from global sellers, whether it’s Italian handbags, Canadian supplements, or Japanese kitchenware, without worrying about surprise import charges.

The end of de minimis means every international purchase, no matter the value, will be subject to full customs clearance and applicable duties/taxes if importing into the US.

Why is the de minimis rule changing?

The U.S. government has argued that the high threshold has been exploited, with billions of dollars’ worth of goods structured to slip under the $800 limit. Concerns range from revenue loss to drug smuggling to unfair competition for domestic retailers.

According to U.S. Customs and Border Protection, de minimis shipments jumped from 636 million parcels in FY2020 to 1.36 billion in FY2024, averaging 3.7 million packages per day.

This has been in a series of regulation changes in 2025 that can be tracked on our Trade and Tariff Hub.

What does it means for you as a shopper?

Without de minimis, the final price you pay for imported goods will rise, sometimes sharply, because duties, taxes, and import fees will now be applied to every purchase. Delivery may also take longer due to increased customs processing.

Here are some real-world examples based on the August 2025 tariff landscape:

Download a PDF of the impact de minimis removal will have on common consumer goods.

| Product | Country of Origin | Pre-Tariff Price | Post-Tariff Price | % Increase | Added Costs |

| Luxury leather handbag | Italy | $1,200 | $1,387.85 | +16% | 9% duty, 6% tariff, $7.85 fee |

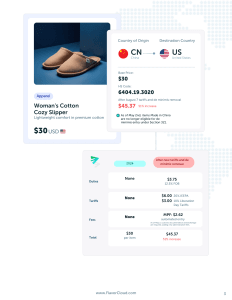

| Cotton slippers | China | $30 | $45.37 | +51% | 12.5% duty, 20% tariff, 10% tariff, $2.62 fee |

| Nutritional supplement | Canada | $37 | $60.17 | +60% | 6.4% duty, 35% tariff, $7.85 fee |

| Japanese chef’s knife | Japan | $240 | $298.49 | +24% | 6.1% duty, 15% tariff, $7.85 fee |

These changes aren’t just about luxury goods. Everyday items, like slippers, supplements, and kitchen knives, will also be hit with higher costs.

Fewer choices, longer waits

The end of de minimis will likely reduce the number of smaller international sellers able to compete in the U.S. market. Many emerging brands will find the extra costs and paperwork too burdensome to justify selling here, which means:

- Less product variety on U.S. marketplaces

- Fewer niche or specialty items from overseas

- Potentially longer shipping times as customs clearance adds processing steps

For Canadian merchants in particular, this is a big shift. Over 85% of Canadian exporters sell to the U.S., and many have built operations around sending low-value parcels duty-free. Now, they’ll face higher costs, more paperwork, and possible fulfillment delays.

How will returns change for consumers?

One hidden consequence of the de minimis removal is the impact on returns. Under the old rule, many items sent back to the U.S. after being shipped under the $800 threshold could avoid paying duties a second time. Now, those protections are gone. If you return an international purchase, you may end up paying duties twice: once on the original shipment and again when the product comes back through customs. Brands may start limiting or charging for international returns to offset these costs, and the refund process itself could take longer as each return must clear customs with full documentation. For shoppers, that means returns will require more time, more paperwork, and potentially more out-of-pocket expense than before.

What can you do as a shopper?

While you can’t control the policy change, you can adjust how you shop:

- Check product origin before you buy. Even U.S. based sites may ship from overseas warehouses.

- Look for DDP (Delivered Duty Paid) at checkout. This means duties/taxes are included upfront, so no surprise bills later.

- Factor duties into your budget. A $50 overseas item could easily become $70+ after fees.

Conclusion

The removal of the $800 de minimis rule is one of the biggest shifts in U.S. trade policy in years. For consumers, it means higher prices, more customs paperwork, and fewer frictionless global shopping experiences. For brands and retailers, it marks the end of a low cost entry point into the U.S. market.

If your favorite overseas brand starts charging more or takes longer to deliver after August 29, now you’ll know why.

If you are a merchant and interested in growing your resilience to changes like the de minimis exemption removal, reach out to our team of experts for more information.

3 Comments

Leave a Comment

Grow your

Revenue

Revenue

With international sales on the rise, the opportunities have no borders. With FlavorCloud, you can tap new markets risk-free by offering global guaranteed delivery promises. Go global today.

[…] to a recent FlavorCloud analysis, a pair of lined slippers made in China and shipped to the U.S. that previously cost $30 when the […]

Does this only apply for shipping overseas products? What about bringing items from traveling abroad? Are we still allowed $800 duty free per person?

Hey Conrad, that is a great question. Shipping and travel duties are different, the de minimis exemption removal just affects shipments. If you are bringing items from traveling abroad and are a US citizen there is other custom regulation that applies (this also has an $800 threshold, to make things very confusing). Read more at CBP: https://www.cbp.gov/travel/us-citizens/know-before-you-go/what-expect-when-you-return